USDA vs FHA vs Conventional Loans: Interest Rates, Appraisal Rules, and Mortgage Calculator Differences Explained

Choosing the right mortgage loan is not just about qualifying. It is about understanding how different loan programs affect interest rates, appraisal standards, monthly payments, and long term affordability. Many buyers compare USDA vs FHA vs conventional loans without fully realizing how differently these programs work behind the scenes.

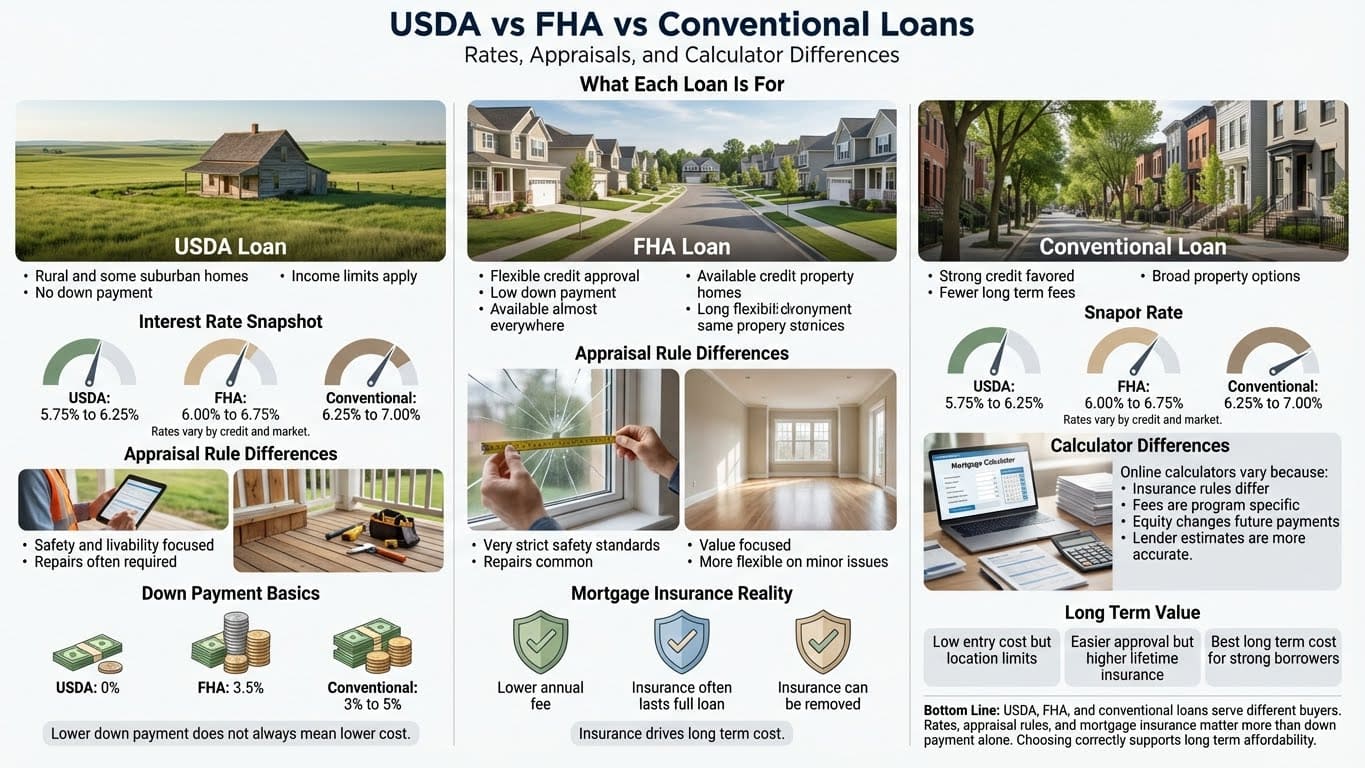

Each loan type is designed for a specific borrower profile and property situation. USDA vs FHA loans comparisons often focus on down payment requirements, but interest rates, appraisal rules, and mortgage calculator accuracy play an equally important role. Understanding these differences helps buyers avoid surprises and choose financing that supports both short term approval and long term stability.

Overview of USDA FHA and conventional loans

Before comparing details, it helps to understand the purpose of each loan type.

USDA home loan

USDA loans are backed by the United States Department of Agriculture and are designed to support homeownership in eligible rural and some suburban areas.

Key features include:

- No down payment requirement

- Income limits based on household size and location

- Geographic property eligibility

- Lower mortgage insurance costs compared to FHA

FHA home loan

FHA loans are insured by the Federal Housing Administration and are designed to help buyers with limited savings or less than perfect credit.

Key features include:

- Low down payment requirement

- Flexible credit standards

- Available in most areas

- Mortgage insurance required for the life of the loan in many cases

Conventional home loan

Conventional loans are not backed by a government agency. They follow guidelines set by private investors.

Key features include:

- Broad property eligibility

- Competitive rates for strong credit borrowers

- Mortgage insurance can be removed with equity

- More flexibility for higher income buyers

USDA vs FHA vs conventional interest rates

Interest rates vary by loan type because each program carries different risk levels for lenders.

Typical interest rate comparison

Actual usda vs fha interest rates depend on credit score, loan size, down payment, and market conditions. USDA loans often have slightly lower rates due to government backing, while conventional loans reward strong credit profiles.

Why interest rates differ by loan type

Rates reflect:

- Level of government guarantee

- Borrower risk profile

- Mortgage insurance structure

- Market demand for each loan type

Lower rates do not always mean lower total cost when insurance and fees are included.

Appraisal rules and property standards

Appraisal requirements are a major difference many buyers overlook.

USDA appraisal requirements

USDA appraisals focus on:

- Property safety

- Structural soundness

- Basic livability

- Market value

Properties must meet USDA standards and be located in eligible areas. Repairs related to safety or habitability are required before closing.

FHA appraisal requirements

USDA vs FHA appraisal requirements often feel similar, but FHA is usually more detailed.

FHA appraisals review:

- Safety hazards

- Structural integrity

- Mechanical systems

- Health related issues

Even cosmetic issues may trigger repair conditions under FHA rules.

Conventional appraisal requirements

Conventional appraisals focus more on:

- Market value

- Overall condition

They are generally more flexible about minor repairs as long as the property is livable and safe.

Appraisal comparison summary

This is an important factor when purchasing older or fixer upper homes.

Down payment and mortgage insurance differences

Down payment requirements affect both upfront and monthly costs.

Down payment comparison

Mortgage calculator differences explained

Many buyers rely on online tools like usda vs fha calculator, usda vs fha loan calculator, or usda vs fha mortgage calculator to estimate payments. These tools are helpful but often incomplete.

Why calculators differ by loan type

Mortgage calculators vary because:

- Insurance costs differ significantly

- USDA and FHA include program specific fees

- Conventional loans remove insurance with equity

- Taxes and insurance estimates vary

A calculator that works for conventional loans may underestimate payments for FHA or USDA loans.

Why calculator results can be misleading

Most calculators:

- Use average insurance assumptions

- Do not reflect county specific taxes

- Do not include HOA dues

- Assume ideal credit profiles

Pre approval estimates from lenders are more accurate than online tools.

Income and eligibility differences

Loan eligibility rules differ significantly.

USDA income limits

USDA loans have strict income limits based on:

- Household size

- County median income

High income buyers may not qualify even with strong credit.

FHA income rules

FHA does not have income limits but focuses on:

- Debt to income ratio

- Stable employment history

This makes FHA accessible to a wide range of buyers.

Conventional income standards

Conventional loans favor:

- Higher credit scores

- Lower debt ratios

- Stable and documented income

They reward financial strength with better pricing.

Long term value considerations

Choosing between usda vs fha vs conventional loans requires thinking beyond approval.

USDA long term value

- Lower monthly insurance

- No down payment

- Geographic restrictions limit resale flexibility

FHA long term value

- Higher insurance cost over time

- Easier entry

- Often refinanced later

Conventional long term value

- Insurance can be removed

- Better long term cost for strong borrowers

- Higher entry requirements

Common buyer mistakes

Buyers often make these errors:

- Choosing based only on down payment

- Ignoring mortgage insurance duration

- Underestimating appraisal requirements

- Relying solely on calculators

- Not planning for long term ownership

Avoiding these mistakes leads to better outcomes.

How buyers should choose

Buyers should evaluate:

- Credit profile

- Income stability

- Property condition

- Location eligibility

- Time in the home

- Comfort with insurance costs

The best loan is the one that fits both current needs and future plans.

Frequently asked questions

Is USDA always cheaper than FHA

Not always. It depends on income eligibility and property location.

Are FHA loans easier to qualify for

They are more flexible for credit but have stricter appraisals.

Can conventional loans have low down payments

Yes, but mortgage insurance applies until sufficient equity is reached.

Do mortgage calculators show true payments

They provide estimates, not final numbers.

Can buyers switch loan types later

Yes. Refinancing can change loan programs.

Final perspective

Comparing USDA vs FHA vs conventional loans goes far beyond down payments. Interest rates, appraisal rules, mortgage insurance, and calculator accuracy all shape the real cost of homeownership. Each loan type serves a purpose, and none is universally better.

Buyers who take time to understand these differences, verify property eligibility, and review full monthly costs are more likely to choose financing that supports long term stability rather than short term convenience.

Get a free instant rate quote

Take a first step towards your dream home

Free & non binding

No documents required

No impact on credit score

No hidden costs

.svg)

.svg)

.svg)