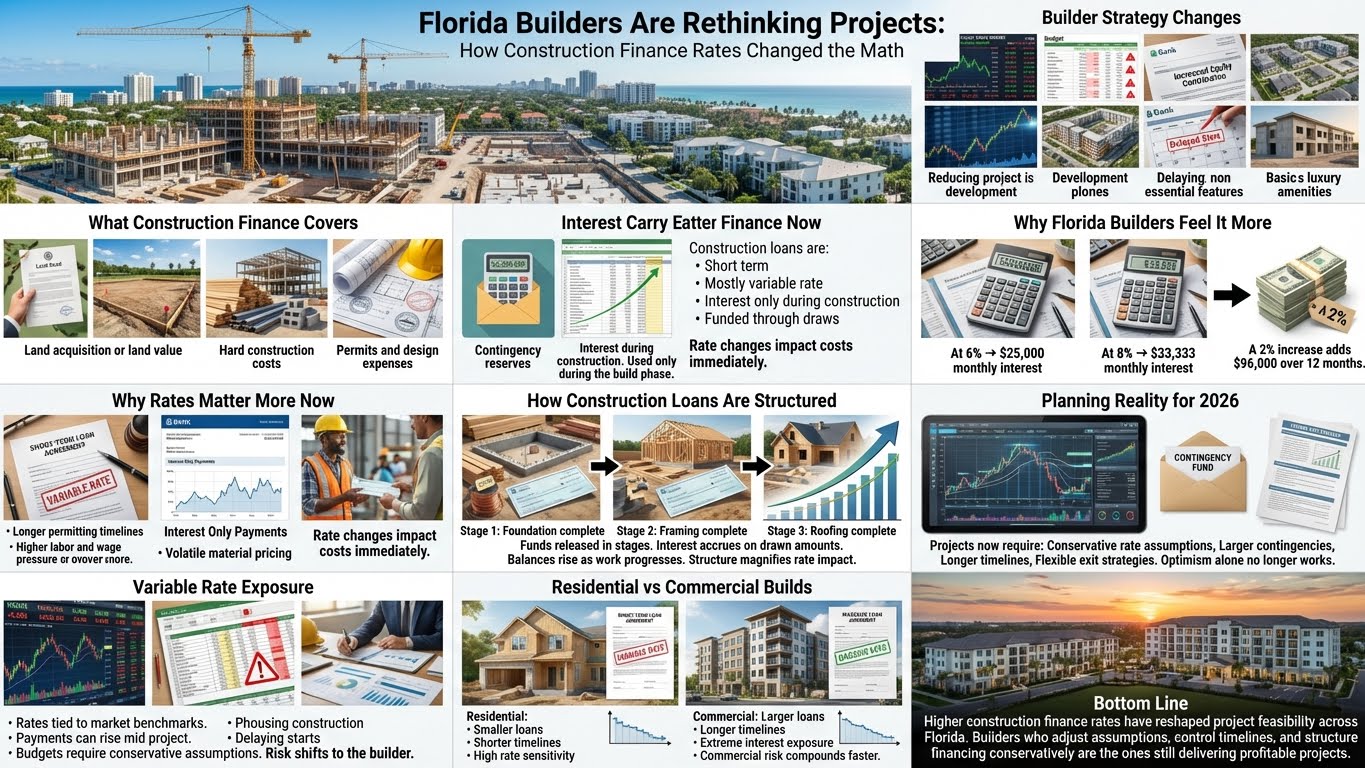

Florida Builders Are Rethinking Projects Because Construction Finance Rates Changed the Math

Across Florida, builders and developers are reassessing new construction projects. The reason is not a lack of demand or land availability. It is the sharp shift in construction finance rates that has changed project feasibility. Financing costs now play a much larger role in whether a project moves forward, pauses, or is redesigned.

For years, low interest environments allowed builders to absorb cost overruns and extended timelines. That flexibility has narrowed. In 2026, construction finance decisions have become central to project planning, profit margins, and risk management. Understanding how construction finance loans work and why rates affect the math so dramatically helps explain why builders are adjusting strategies across Florida.

What construction finance means

Construction finance refers to short term lending used to fund the building of residential or commercial property. Unlike permanent mortgages, construction loans are designed to cover costs during the building phase.

A typical construction finance loan covers:

- Land acquisition or land value

- Hard construction costs

- Soft costs such as permits and design

- Contingency reserves

- Interest during construction

Once the project is completed, the construction loan is usually replaced by permanent financing or paid off through sale.

Why construction finance rates matter more than ever

Construction loans are fundamentally different from standard mortgages.

Key differences include:

- Shorter loan terms

- Variable interest rates

- Interest only payments during construction

- Draw based funding

Because of these features, changes in rates impact monthly interest carry immediately.

The math behind interest carry

Interest carry is the cost of borrowing during construction. It directly affects project profitability.

Simple interest carry example

An increase of 2.00 percent raises monthly carrying cost by more than 8000 dollars. Over a 12 month build, that difference exceeds 96000 dollars.

This change alone can turn a marginal project into an unworkable one.

Why Florida builders feel the impact strongly

Florida builders face unique pressures that amplify the effect of higher rates.

Longer permitting timelines

In many Florida jurisdictions, permitting and inspections take longer than national averages.

Longer timelines mean:

- More interest months

- Higher total carry cost

- Greater exposure to rate volatility

Even small delays can add meaningful expense.

Labor and material cost pressure

Construction costs have not declined significantly.

Builders continue to face:

- Skilled labor shortages

- Higher wage expectations

- Volatile material pricing

When financing costs rise alongside build costs, margins compress quickly.

Land pricing rigidity

Land prices in many Florida markets remain elevated.

Builders who paid premium prices for land under previous rate assumptions must now finance that land at higher costs, reducing flexibility.

How construction finance loans are structured

Understanding loan structure helps explain why rate changes matter so much.

Draw schedules

Construction finance loans release funds in stages.

Typical draw categories include:

- Foundation

- Framing

- Mechanical systems

- Interior finishes

- Completion

Interest accrues on funds drawn, not the full loan amount, but balances grow quickly as construction progresses.

Variable rate exposure

Most construction finance loans use variable rates tied to market benchmarks.

This means:

- Monthly interest can change during the project

- Budgeting requires conservative assumptions

- Rate increases immediately affect cash flow

Fixed rate construction loans are rare and often priced higher.

Interest reserves

Some construction finance loans include interest reserves.

Interest reserves:

- Cover interest payments during construction

- Reduce monthly out of pocket expense

- Still increase total project cost

When rates rise, interest reserves must be larger, tying up more capital.

How builders are rethinking projects

Higher construction finance rates have changed decision making.

Project downsizing

Some builders are:

- Reducing square footage

- Simplifying design

- Eliminating non essential features

Smaller projects reduce loan size and interest carry.

Phased construction

Builders are increasingly using phased builds.

This approach:

- Limits initial borrowing

- Reduces early interest exposure

- Allows reassessment before full commitment

Phasing lowers risk but may extend timelines.

Delaying starts

Some projects are delayed until:

- Rates stabilize

- Pre sales improve

- Cost certainty increases

Delay avoids high carry but risks missing market windows.

Higher equity contributions

Builders are contributing more equity to reduce loan size.

While this lowers interest cost, it:

- Reduces return on equity

- Increases capital at risk

This tradeoff is becoming more common.

Role of a construction finance company

A construction finance company provides lending specifically tailored to building projects.

Experienced construction lenders:

- Understand draw management

- Assess cost overruns realistically

- Price risk based on project type

- Monitor progress closely

Choosing the right lender affects both cost and execution.

Why construction finance brokers matter

A construction finance broker helps builders navigate complex lending options.

Brokers add value by:

- Comparing multiple lenders

- Negotiating terms

- Structuring interest reserves

- Matching projects to lender appetite

In higher rate environments, structure matters as much as rate.

Construction finance rates and feasibility analysis

Builders now rely more heavily on feasibility modeling.

Key variables include:

- Total interest carry

- Contingency size

- Timeline buffers

- Exit assumptions

- Sale price sensitivity

Small changes in rates can shift feasibility outcomes dramatically.

Residential versus commercial construction finance

Both sectors feel pressure, but impacts differ.

Commercial projects often face greater exposure due to longer timelines.

What builders must plan for in 2026

Construction finance planning now requires:

- Conservative rate assumptions

- Longer timelines

- Larger contingencies

- Flexible exit strategies

Optimism alone no longer supports feasibility.

Common mistakes builders are avoiding

Experienced builders are moving away from:

- Thin margin projects

- Aggressive timeline assumptions

- Minimal interest reserves

- Single lender dependency

- Ignoring rate volatility

Discipline has become a survival skill.

How projects can still succeed

Despite challenges, projects can succeed when:

- Pricing reflects current costs

- Financing is structured conservatively

- Demand supports absorption

- Equity is aligned with risk

- Lenders and builders communicate closely

Higher rates change the math, but they do not eliminate opportunity.

Frequently asked questions

What is a construction finance loan

It is a short term loan used to fund building costs until completion.

Why are construction finance rates higher

They reflect short term risk, variable rates, and project uncertainty.

Do rates change during construction

Yes. Most construction loans have variable rates.

Can builders lock rates

Rarely. Most loans remain variable through construction.

Is construction still viable in Florida

Yes, but only with realistic cost and financing assumptions.

Final perspective

Construction finance rates have reshaped how Florida builders evaluate projects. Higher borrowing costs magnify delays, compress margins, and force more disciplined planning. Builders are responding by downsizing projects, increasing equity, phasing construction, and relying more heavily on expert construction finance partners.

In 2026, success in construction is no longer driven by optimism alone. It depends on accurate math, conservative assumptions, and financing strategies that reflect today’s rate environment. Builders who adapt to this reality are more likely to deliver profitable projects even as conditions evolve.

Get a free instant rate quote

Take a first step towards your dream home

Free & non binding

No documents required

No impact on credit score

No hidden costs

.svg)

.svg)

.svg)